Six months ago, I alerted readers to the very attractive benefits that the TreasuryDirect program offers to investors who are defensively sitting on cash right now.

Since then, those benefits have continued to improve. Substantially.

Back in November, by holding extremely conservative short-term (i.e., 6-months or less) Treasury bills, TreasuryDirect participants were receiving over 16x more in interest payments vs keeping their cash in a standard bank savings account.

Today, they're now receiving over 30 times more. Without having to worry about the risk of a bank "bail-in" or failure.

So if you're holding cash right now and NOT participating in the TreasuryDirect program, do yourself a favor and read on. If you're going to pass on this opportunity, at least make it an 'eyes-wide-open' decision.

Holding Cash (In Treasurys) Now Beats The Market

There are many prudent reasons to hold cash in today's dangerously overvalued financial markets, as we've frequently touted here at PeakProsperity.com.

Well, there's now one more good reason to add to the list: holding cash in short-term Treasurys is now meeting/beating the dividend returns offered by the stock market:

"Cash Is King" Again - 3-Month Bills Yield More Than Stocks (Zero Hedge)'Reaching for yield' just got a lot easier...

For the first time since February 2008, three-month Treasury bills now have a yield advantage over the S&P 500 dividend yield (and dramatically lower risk).

Investors can earn a guaranteed 1.90% by holding the 3-month bills or a risky 1.89% holding the S&P 500...

The longest period of financial repression in history is coming to an end...

And it would appear TINA is dead as there is now an alternative.

And when you look at the total return (dividends + appreciation) of the market since the start of 2018, stocks have returned only marginally better than 3-month Treasurys. Plus, those scant few extra S&P points have come with a LOT more risk.

Why take it under such dangerously overvalued conditions?

If You Can't Beat 'Em, Join 'Em

In my June report Less Than Zero: How The Fed Killed Saving, I explained how the Federal Reserve's policy of holding interest rates at record lows has decimated savers. Those who simply want to park money somewhere "safe" can't do so without losing money in real terms.

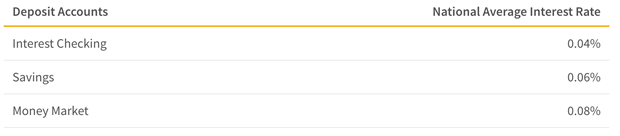

To drive this point home: back in November, the average interest rate being offered in a US bank savings account was an insutling 0.06%. Six months later, nothing has changed:

That's virtually the same as getting paid 0%. But it's actually worse than that, because once you take inflation into account, the real return on your savings is markedly negative.

And to really get your blood boiling, note that the Federal Reserve has rasied the federal funds rate it pays banks from 1.16% in November to 1.69% in April. Banks are now making nearly 50% more money on the excess reserves they park at the Fed -- but are they passing any of that free profit along to their depositors? No....

This is why knowing about the TreasuryDirect program is so important. It's a way for individual investors savvy enough to understand the game being played to bend some of its rules to their favor and limit the damage they suffer.

Below is an updated version (using today's rates) of my recap of TreasuryDirect, which enables you to get over 30x more interest on your cash savings than your bank will pay you, with lower risk.

TreasuryDirect

For those not already familiar with it, TreasuryDirect is a service offered by the United States Department of the Treasury that allows individual investors to purchase Treasury securities such as T-Bills, notes and bonds directly from the U.S. government.

You purchase these Treasury securities by linking a TreasuryDirect account to your personal bank account. Once linked, you use your cash savings to purchase T-bills, etc from the US Treasury. When the Treasury securities you've purchased mature or are sold, the proceeds are deposited back into your bank account.

So why buy Treasuries rather than keep your cash savings in a bank? Two main reasons:

- Much higher return: T-Bills are currently offering an annualized return rate between 1.66-2.04%. Notes and bonds, depending on their duration, are currently offering between 2.6% - 3.1%

- Extremely low risk: Your bank can change the interest rate on your savings account at any time -- with Treasury bills, your rate of return is locked in at purchase. Funds in a bank are subject to risks such as a bank bail-in or the insolvency of the FDIC depositor protection program -- while at TreasuryDirect, your funds are being held with the US Treasury, the institution with the lowest default risk in the country for reasons I'll explain more in a moment.

Let's look at a quick example. If you parked $100,000 in the average bank savings account for a full year, you would earn $60 in interest. Let's compare this to the current lowest-yielding TreasuryDirect option: continuously rolling that same $100,000 into 4-week T-Bills for a year:

- Day 1: Funds are transferred from your bank account to TreasuryDirect to purchase $100,000 face value of 4-week T-Bills at auction yielding 1.68%

- Day 28: the T-Bills mature and the Treasury holds the full $100,000 proceeds in your TreasuryDirect account. Since you've set up the auto-reinvestment option, TreasuryDirect then purchases another $100,000 face value of 4-week T-Bills at the next auction.

- Days 29-364: the process repeats every 4 weeks

- Day 365: assuming the average yield for T-Bills remained at 1.68%, you will have received $1,680 in interest in total throughout the year from the US Treasury.

$1,680 vs $60. That's a 27x difference in return.

And the comparison only improves if you decide to purchase longer duration (13-week or 26-week) bills instead of the 4-week ones:

Repeating the above example for a year using 13-week bills would yield $1,925. Using 26-week bills would yield $2,085. A lot better (34x better!) than $60.

Opportunity Cost & Default Risk

So what are the downsides to using TreasuryDirect? There aren't many.

The biggest one is opportunity cost. While your money is being held in a T-Bill, it's tied up at the US Treasury. If you suddenly need access to those funds, you have to wait until the bill matures.

But T-Bill durations are short. 4 weeks is not a lot of time to have to wait. (If you think the probability is high you may to need to pull money out of savings sooner than that, you shouldn't be considering the TreasuryDirect program.)

Other than that, TreasuryDirect offers an appealing reduction in risk.

If your bank suddenly closes due to a failure, any funds invested in TreasuryDirect are not in your bank account, so are not subject to being confiscated in a bail-in.

Instead, your money is held as a T-Bill, note or bond, which is essentially an obligation of the US Treasury to pay you in full for the face amount. The US Treasury is the single last entity in the country (and quite possibly, the world) that will ever default on its obligations. Why? Because Treasurys are the mechanism by which money is created in the US. Chapter 8 from The Crash Course explains:

As a result, to preserve its ability to print the money it needs to function, the US government will bring its full force and backing to bear in order to ensure confidence in the market for Treasurys.

Meaning: the US government won't squelch on paying you back the money you lent it. If required, it will just print the money it needs to repay you.

So, How To Get Started?

Usage of TreasuryDirect is quite low among investors today. Many are unaware of the program. Others simply haven't tried it out.

And let's be real: it's crazy that we live in a world where a 1.68-2.09% return now qualifies as an exceptionally high yield on savings. A lot of folks just can't get motivated to take action by rates that low. But that doesn't mean that they shouldn't -- money left on the table is money forfeited.

So, if you're interested in learning more about the TreasuryDirect program, start by visiting their website. Like everything operated by the government, it's pretty 'no frills'; but their FAQ page addresses investors' most common questions.

Before you decide whether or not to fund an account there, be sure to discuss the decision with your professional financial advisor to make sure it fits well with your personal financial situation and goals. (If you're having difficulty finding a good one, consider scheduling a free discussion with PeakProsperity.com's endorsed financial advisor -- who has considerable experience managing TreasuryDirect purchases for many of its clients).

In Part 2: A Primer On How To Use TreasuryDirect, we lay out the step-by-step process for opening, funding and transacting within a TreasuryDirect account. We've created it to be a helpful resource for those self-directed individuals potentially interested in increasing their return on their cash savings in this manner.

Yes, we savers are getting completely abused by our government's policies. So there's some poetic justice in using the government's own financing instruments to slightly lessen the sting of the whip.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

NOTE: PeakProsperity.com does not have any business relationship with the TreasuryDirect program. Nor is anything in the article above to be taken as an offer of personal financial advice. As mentioned, discuss any decision to participate in TreasuryDirect with your professional financial advisor before taking action.

JIM WATSON / Contributor | Getty Images

JIM WATSON / Contributor | Getty Images

Joe Raedle / Staff | Getty Images

Joe Raedle / Staff | Getty Images AASHISH KIPHAYET / Contributor | Getty Images

AASHISH KIPHAYET / Contributor | Getty Images Harold M. Lambert / Contributor | Getty Images

Harold M. Lambert / Contributor | Getty Images