Earlier this week, Politico published a hit piece on Senator Rand Paul over his push to audit the Federal Reserve. The article claims that Sen. Paul isn't telling the truth and this is just a calculated way for him to energize the Libertarian base. Glenn invited Sen. Paul onto the radio show today to respond to the attacks one by one.

Below is a rush transcript of the interview

GLENN: Welcome to the program. Senator Rand Paul is joining us. We're excited to have him on. He was supposed to be on yesterday. There was a scheduling conflict. Misunderstanding. We missed him yesterday. We're glad to have him on today to respond to an article that was in Politico that I think was a massive hatchet job on him on -- in many ways. But they -- they bring up a lot of points that, unless you're really well-versed in The Fed, you might look at this and say, well, gosh, I don't know who to believe because this all makes sense. Maybe Rand Paul is lying. But they bring up very specific points that he should be able to answer. And if he can't answer them, then we know that it was an absolute hatchet job and it only makes his case stronger and we see the game that is being played.

Welcome to the program, Senator Rand Paul. How are you, sir?

SENATOR PAUL: Good morning, Glenn. Thanks for having me.

GLENN: You bet. So, Senator, I want to talk to you about the Politico article. But I really want -- how much time do we have with you?

SENATOR RAND: Oh, a couple hours. Whatever you need.

[laughter]

GLENN: So I want to just kind of go over exactly what they said so you can explain it. Because you're an expert on The Fed. I mean, you know, relatively speaking. And they bring up a lot of points that somebody like me looks at and says, well, gee, that kind of makes sense. What's Rand talking about? So let's go over these point-by-point. They say, The Fed has $4.5 trillion in assets, mostly treasury bonds, mortgage-backed securities guaranteed by the federal government. It only has 57 billion in equity because it spends -- sends most of its profits to the US treasury, a total of around 500 billion over the past decade. So it actually has no leverage in the traditional sense of the word, meaning debt, because it doesn't borrow money like Lehman Brothers before it went bankrupt.

SENATOR PAUL: It kind of makes me laugh, a little bit, Glenn. They don't borrow money, they just create it. So they bought during the last several years, they bought trillions of dollars of assets. And you say, well, an asset should be good. Right? To have an asset. Well, they create the money to buy the asset. So on the liability side of the ledger, they have almost the same amount of liabilities. But they didn't borrow money from someone. They didn't go out and work and earn it. They just created a computer entry to pay the banks for these assets.

And the point I've been making is, who did they buy these things from, and what did they pay for them? So for example, let's say I'm the chairman of The Fed and my brother owns the bank, shouldn't the American public know if I buy my brother's bank and I pay 100 percent value when maybe it was only worth 10 percent? The whole idea during this crisis was that they forced private industry to mark to market. Meaning you had to immediately discount what your company was worth if it was losing value, whether you were selling it or not. The Fed doesn't do the same thing. The Fed has 4.5 trillion dollars' worth of so-called assets. We don't know what they are. We don't know what they're worth, what they paid for them. And are they marking them to market? And what would happen to The Fed and to the country if they were to mark them to market?

GLENN: They said in your op-ed, you claimed that The Fed has $4.5 trillion in liabilities, not assets, and $57 billion in equity. Donald Kohn, the former vice chair said, there's essentially no credit risk on the Federal Reserve's balance sheet right now. I don't know of any institution in the United States that is subject to more oversight than The Fed.

SENATOR PAUL: When they say there's no credit risk, they created four and a half trillion dollars to buy these bad mortgages. So is there no risk in creating it? If it's a great thing -- they brag they made 500 billion or whatever they made in interest over the last 10 years. Well, if it's good, why not create more money?

So if they bought 400 trillion dollars' worth of asset by printing up money or by computer entry, why not create, oh, I don't know, 9 trillion worth, and they can double their so-called profit. See, it's like the emperor has no clothes when people finally discover, yeah, they have a profit, but their profit is made by creating money out of thin air, or creating a computer entry and buying stuff. But then there's a whole question of favoritism. Is there any conflict of interest? Are any of these assets, so-called assets, which are sometimes bad car loans, bad home loans, are any of these assets owned by friends of theirs? You know, for about the last two decades, there's been a revolving door between the fed, the Treasury, and Wall Street again. And I frankly live and fly over America, and I'm tired of paying for it. I'm tired of bailing out these big banks when they make bad decisions.

STU: I think you're being rude to Lehman Brothers by comparing them to Lehman Brothers.

GLENN: Okay. So here's Politico. Problem number one. They say problems with your bill. Problem number one. The article says the bank's finances are already subject to an audit by the GAO, the Government Accountability Office, the Federal Inspector General and outside audit firms.

SENATOR PAUL: There's a really great exchange, and your staff can find this. There was a committee hearing, and the congressman asked the auditor if he brought the auditor before the committee, he asked the auditor, during the crisis, you know, it was like four or five, six, $7 trillion had changed hands. I think the question and the point was: Do you know what was purchased with the $2 trillion?

And the auditor said, oh, we're not allowed to audit Federal Bank Reserve activities. So the auditor has no idea what they purchased. So really, I don't think that's a real audit. We have a bunch of fake audits. And the fake audits don't reveal any of the information we want to know. We want to know: Who are they buying the stuff from. What are they paying for it? Are they paying a fair market rate or because it's someone's brother-in-law, they're actually paying more for something than it's actually worth.

If your home is worth 150,000, that's the mortgage on it, but the market drops off by a third, shouldn't the Federal Reserve be able to buy that at 150,000? And what if it's their brother-in-law or cousin? We don't know any of that. So we don't really have an audit. It's appalling that something Congress creates is such an enormous creature -- a creature that creates its own money is now lobbying government. They should be forbidden from lobbying government and forbidden from trying to influence legislation. I think it's appalling that they're trying to stop any oversight of the Federal Reserve.

GLENN: Well, they're saying, again, back to the article, those interested in what is on the Fed's balance sheet can actually find out. Down to the individual bond on the website of the New York Federal Reserve.

SENATOR PAUL: I think that that's true and untrue at the same time. There are lists of what their assets are. But they aren't individualized. You can't tell who they bought them from or whether they were bought at fair market price or whether they were bought at a haircut and whether or not there were any conflicts of interests in the buying and selling. I mean, Bear Stearns is bailed out, Lehman Brothers isn't. Does that have anything to do with who runs the bank or who owned the banks? I mean, these are questions -- the bank was created by Congress. So they talk about independence from Congress. Well, no, Congress created the bank. Congress should be the one overseeing the bank. The independence we need is independence from the executive branch. The executive branch is always meddling in The Fed. And I frankly think that we need to break up some of the -- you know -- of the I guess intermingling of policy between Treasury and Fed and have more congressional oversight on what's going on.

GLENN: Let me -- this kind of goes right into problem number three, they say. Critics of the bill say that it's aimed much more directly at repealing a 1978 law establishing Fed independence on monetary policy decision. Paul's Bill, though vaguely written, would likely allow the GAO to investigate monetary policy actions and report back to Congress immediately.

SENATOR PAUL: You know, it's just a lookback provision. It's actually a one-time audit that looks back at the end of the year. And we think it would be a good idea. And basically what the bill does, it reveals prohibitions against auditing. So when they say there are being audited, there are four prohibitions that prevent full audits from occurring. All we do is repeal the prohibitions on full audits. And I think most American people have a little worry. We went to where people making $100 million a year on Wall Street ran their banks into the ground by poor decisions, buying derivatives and doing all this crazy trading, and what happens, those people don't miss a beat, and the next year they're making $100 million. But there's a lot of us living in middle America who are struggling. When we talk about the middle class still struggling, the rich getting richer, some of us want to know what the Federal Reserve is doing and whether they're bailing out their wealthy friends or -- and what are the consequences for the rest of us in middle America.

GLENN: Just off the subject here for a second. Have you seen the documentary, Money for Nothing?

SENATOR PAUL: I think so, or I've seen bits of it.

GLENN: It's really good. If you happen to be listening and want to know the history of The Fed and what some of the things is that senator Rand Paul is talked about. Watch this. You can find it on Netflix. It's from Liberty Streets Films. It's called Money for Nothing. And it's about The Fed and, quite honestly, many of the problems that they've caused. And part of it is because of this 1978 bill where they were also charged with -- and this to me makes so much sense, they were charged with also worrying now not just about inflation, but the unemployment numbers. And so now the balance is, do we care -- do the people care more about inflation, or do the people care more about the unemployment numbers? And so it's become wildly politicized. And you can't serve both of those masters. And right now, we're printing up the money because they're not concerned about inflation, and the pressure is, get the economy moving, get the jobs created. And they'll destroy our monetary base.

SENATOR PAUL: Here's another thing, Glenn. In the crisis of 2008, there are reports that The Fed bought 3 trillion dollars' worth of foreign bank securities. Really, we now have a bank created by Congress that is actually buying foreign banks and buying foreign debt. And that's really concerning, that this all goes on in secret, even after the fact. They don't want to tell us after the fact what they did. And it's very concerning. And it's too much power to have gravitated into one sort of secretive bank. And I think most Americans would like to see it audited. If you look at polling on it or look at the votes, in the House, every Republican voted for this. And 100 Democrats. 350 votes in the House twice now. And yet, now The Fed has come all out onslaught push against this. It should worry people that an individual bank that has the monopoly privilege granted to it by Congress is able to print money to be able to lobby against legislation that would cause more oversight. That should worry all of us.

GLENN: Real quick, two other things that need a quick comment on. One of them was kind of a smear on you. The whole piece was a smear. This one they just talked about how you were on my show on 2011. You said, I worry about the Weimar Republic. I worry about 1923 in Germany when they destroyed the currency when they elected Hitler. I don't want something like that to happen in our country. They're trying to make you sound like a nut job by saying that we could have hyperinflation. Do you stand by that worry?

SENATOR PAUL: Well, I think the question they have to answer to the American people is that, if create a computer entry for four and a half trillion dollars and you buy a bunch of stuff with it, is it really -- it's like the emperor has no clothes. They go around the world saying we're such a great and productive bank. We have all this profit. We created four and a half trillion dollars' worth of money. We bought some assets that bear interest. So we're making money. It's like, wow, that's great. Make more money then. Is there no limit? This is the question we should ask. Is there no limit to the amount of money that The Fed can create? And is there -- at some point, is there some ramifications? In Germany, it was hyperinflation. Right now, some of what they're doing worries people in the opposite direction because all this money that's being created, The Fed buys stuffs for the banks, distressed assets often, from the banks, but then the banks put it back in The Fed, and it doesn't get out into the system. And then The Fed pays them interest, which is a relatively new phenomenon. But as a consequence, there's enormous amount of money piling up. The banks are getting richer. Who are making -- you know, they're only making a quarter of a point of interest. But if you give some banks billions of dollars for assets that weren't worth much and then they're able to make easy money on it, is that really fair to the rest of the country that's struggling?

GLENN: The last point in the article, they say, this is only you. You don't believe any of this. You are smarter than this. You know that anybody can see, there's no use to the audit, and you're just playing to a dumb conservative or Libertarian base.

SENATOR PAUL: Well, that sounds like the people who call us Flyover America. They discount any knowledge. But they also discount any true belief and worry about our country. I think the one sincere thing that came out of the Tea Party movement and that still exists in the country is that there are millions of us that are worried about the future of the country. We're worried about the enormous death debt we're incurring. We're worried about the ramifications of the Federal Reserve simply creating money to pay for that debt. And, yeah, I'm very sincere in this. I do none of this for gamesmanship. I'm very concerned about the future of our country. Does that mean I think that it will end tomorrow in a Weimar Republic-type inflation? No one knows the future and when things will happen or if it will happen. But I am concerned about a bank that creates trillions of dollars of money, buys up distressed assets, and then says, hey, look how profitable we are.

GLENN: Last question on a different topic. The FCC net neutrality. We are so against net neutrality. There is a lot of confusion on this. A lot of people that just I think don't know what they're doing and don't know they're in bed with Marxists. I think this is a killer of the economy and a killer of freedom of speech. Is it going to pass?

SENATOR PAUL: You know, I think it won't get through the legislature. Like everything else, the president is doing it by executive Fiat. This is the biggest worry in our country right now, the president's usurpation of power. The checks and balances that our founders gave us, net neutrality is one example. Amending Obamacare is another. Immigration is another. Even going to war without Congress voting. All of these things are leading to an extraordinarily strong president and that's bad fort republic.

GLENN: Can you stop net neutrality if the FCC takes it on? Will you stop net neutrality?

SENATOR PAUL: Actually we might be able to. We couldn't when the Democrats were in charge, but there is a special rule called the Congressional Review Act. By a simple majority in the House or the Senate, we can overturn regulation when it comes forward. The only downside is that it would still have to be signed by the president. But I think we can actually in both houses turn enough numbers to overcome any terrible regulations that he does now. But the difficulty will be is that it still has to be signed by him, which he is unlikely to do.

GLENN: Senator Rand Paul, thank you so much. Thanks for clearing this up. I stand by, I think this was a bad smear job. By desperate, desperate people. And we wish you all the best.

SENATOR PAUL: Thanks, Glenn.

GLENN: Senator Rand Paul.

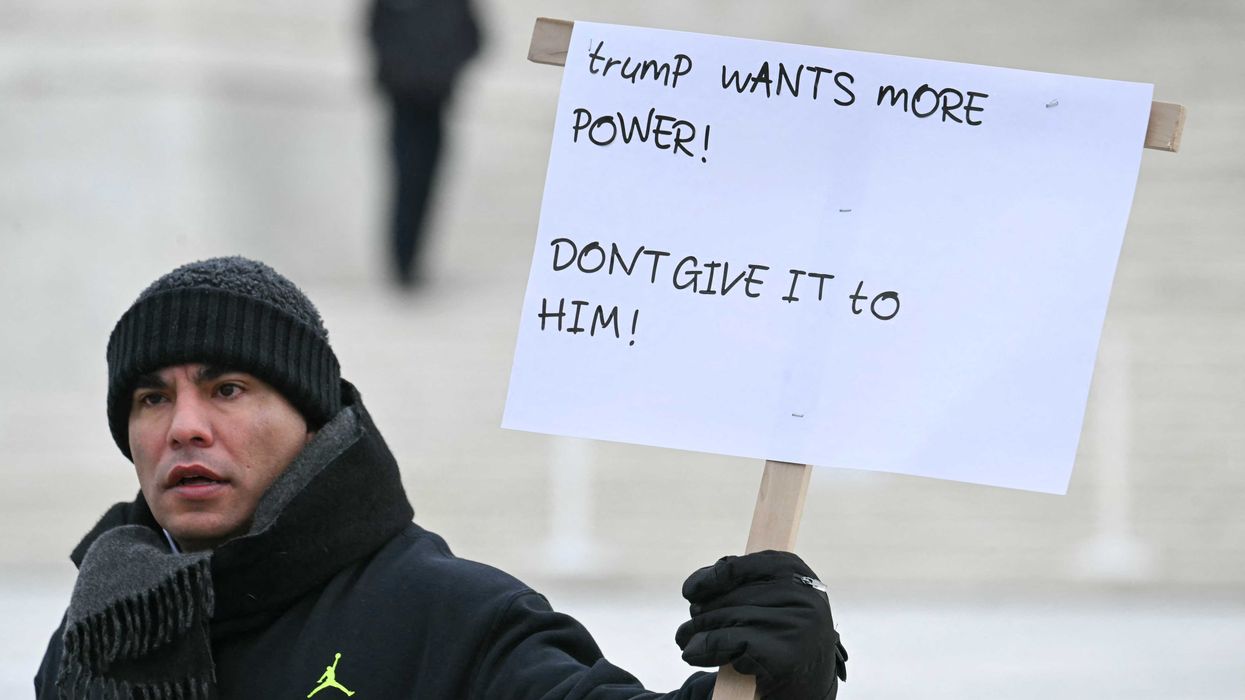

Featured image courtesy of the AP

JIM WATSON / Contributor | Getty Images

JIM WATSON / Contributor | Getty Images

Joe Raedle / Staff | Getty Images

Joe Raedle / Staff | Getty Images AASHISH KIPHAYET / Contributor | Getty Images

AASHISH KIPHAYET / Contributor | Getty Images Harold M. Lambert / Contributor | Getty Images

Harold M. Lambert / Contributor | Getty Images